If I'm on H1b Which Tax Form Do I Use

Usually H1B workers have to have a certain level of income and therefore pay between 25 and 28 on taxable income. I was in USA for around 4 months Jun-2010 to Sep-2010 during 2010 on H1B Visa and currently in India.

Us Tax For Nonresidents Explained What You Need To Know

Federal Income Tax on an H1B If you are a nonresident and working in the US on an H1B visa you will be taxed on money that you make in the US at the same rate as US citizens.

. I have been on F1 since April 2001 and received my OPT on June 2006 I worked on my OPT till. H1b visa holder can I use turbotax to e-file my tax return. If there is a difference about tax policy do I need to file separate forms for my 2 different visa type period.

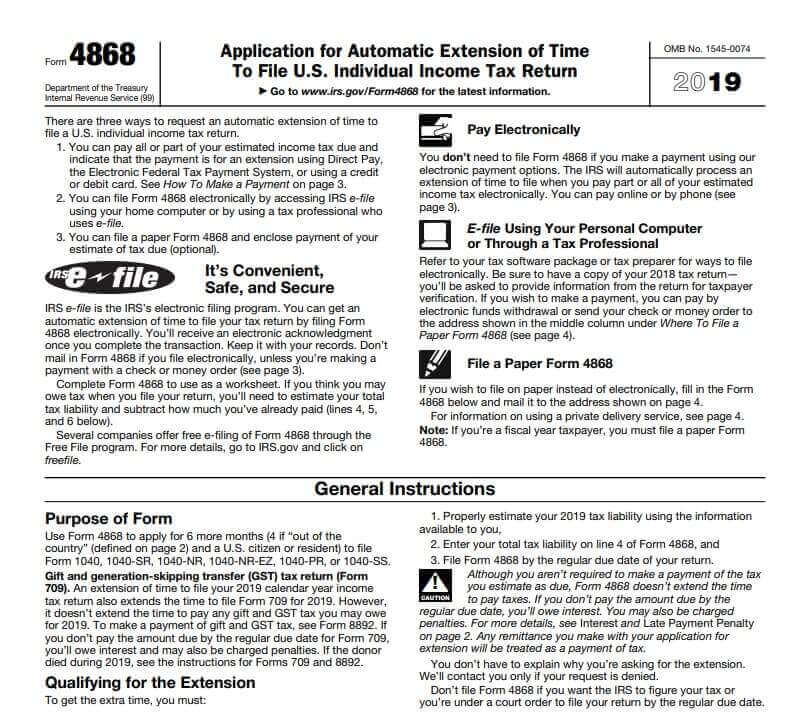

Form 1040-C is used by aliens who intend to leave the United States or any of its possessions to report income received or expected to be received for the entire tax year and pay the expected tax liability on that income if they are required to do so. Individual Income Tax Return in the same manner as if they were US. So could you please tell me which forms i.

Your tax advisor can tell you which choice is best for your situation. Sprintax can also help you get a FICA Tax refund. Dear Kathy Im a scientist working with a research group.

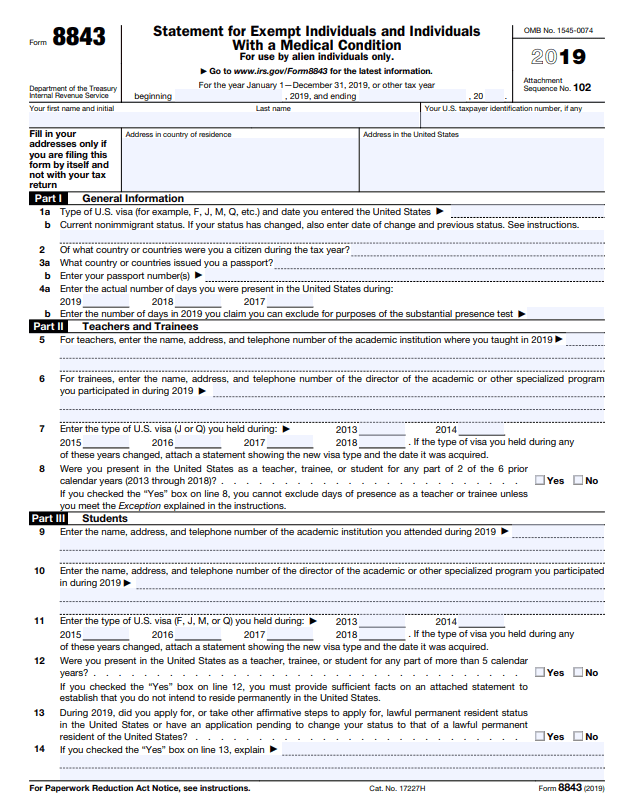

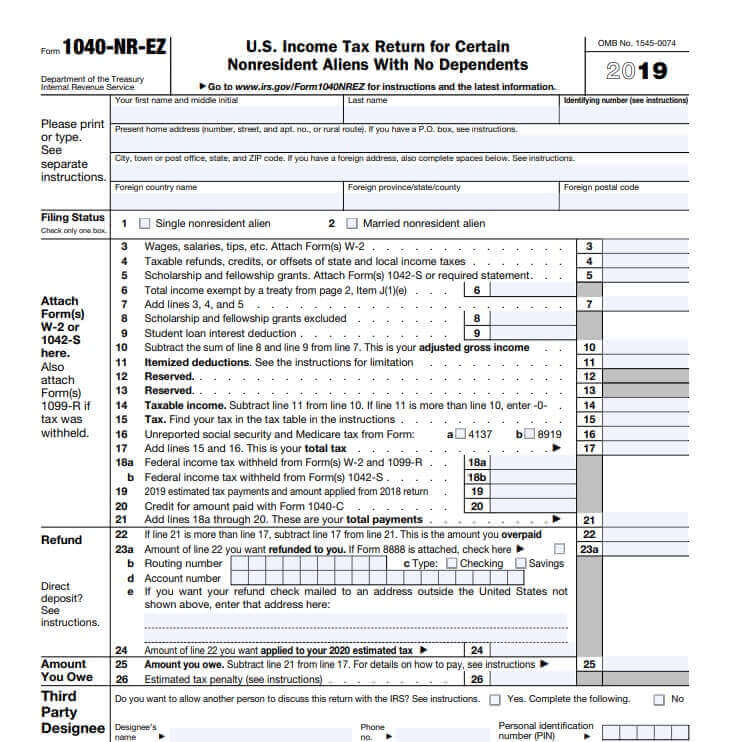

As an F1 visa student most students file form 1040NR or 1040NR-EZ because they are non resident aliens as per the substantial presence test. As a result the foreign national is required to pay US. H1B visa holders are living and working in the US so they are on track to become citizens.

H1B Visa Holders in USA do find difficulty in knowing about their eligible deductions and credits having better understanding about credits and deductions will possibly reduce. Although not all follow through a significant percentage do go on to get their green cards. I have recently returned back from US in H1B status to India on April 1st week of 2016.

You have established tax residency so you can use form 1040 itemized or 1040 EZ standard to file your tax return. While filing taxes a person needs to make sure to pay the state taxes as well. Pay tax on your worldwide income.

Persons for tax and reporting purposes. Fee for filing I-129. The higher your income the higher the tax you have to pay.

Another tax that a non-resident F-1 J-1 can be exempt from is FICA but if you are a H1B visa holder then you have to pay FICA tax. The following documents should be organized in a given order when filing H1B Petition. This means you will be required to pay tax on all interest earned from banks in foreign countries.

F1-OPT-H1B Tax status 1 Answers I realize this topic may have been beaten to death but I am hoping someone would be kind enough to help me out. H-1B aliens who are US. For more information about the Form 1040C refer to the Instructions for Form 1040C.

If this was compensation for services that you rendered as an employee that you received in 2016 it should have been included on your W-2 and had payroll taxes withheld. As Im eligible to file Income Tax for the period of 2016 calendar year can I file W8 BEN form. On an H1B visa you have to pay Federal State Social Security and Medicare tax based on your income.

Most unmarried H1B workers will pay a rate of 25-28 on taxable income the amount after exemptions based on average H1B occupation wage levels. You can also use popular software such as TurboTax and HR Block. I have read some where that H1 is considered a resident visa.

Resident aliens for the entire taxable year must report their entire worldwide income on Form 1040 US. If you are married and your spouse is living on H4 with you you can file as married filing jointly and can get better standard deduction 12600 in 2015 as compared to filing single 6300 in 2015. File Your Non-Resident Taxes via SprinTax.

According to US tax laws if you are a US resident who also holds an H1-B visa you are required to pay tax on your worldwide income. You are obliged to file a US tax return Form 1040NR but. I received my W-2 from my employer and am trying to file my tax returns.

So what happens when their visa status changes to H1b. You will get the ITIN by filling in a W-7 form. Tax on worldwide income domestic and foreign sourced and report their global assets to the IRS in accordance with FBAR and FATCA.

1500 employer funded training fee 750 for employers with fewer than 25 full-time employees in the United States This fee is also called American Competitiveness and Workforce Improvement Act of 1998. If they do they become eligible to receive Social Security and Medicare like. The federal income tax rate ranges from 10 to 396.

My doubt is which form should I use f1040-EZ or f1040-NREZ for filing my tax returns. 31700 satisfied customers. The question is that Im performing a forex trading from my home country.

It depends on you filing status. I came from India on H1B visa on 31st may and join my job on 1st june. There are many discounts available for TurboTax and H.

Since my visa status changes in 2016 I knew that OPT status I can be exempted from SSN tax and Medicare tax how about h1B will I still be exempted from those tax. For tax year 2016 which form should I use 1040NR or 1040. Income Tax Benefits Information for H1B Visa Holders in USA.

You are considered as a resident for tax purposes if meet the Substantial Presence Test after staying in US for five years. I have recently returned back from US in H1B status to. When an H-1B visa holder meets Substantial Presence they are treated as US.

Not sure why the employer did this. If they also paid foreign income tax on foreign-source income they may be eligible for foreign tax credits. The US tax rate for individual ranges from 10 to 396 depending on your income level.

For tax year of 2015 in their case total exemption was 4 x 400016000. The most common and confusing question students have is what tax form to file when their visa status changes from F1 to H1b. This is a great H1-B tax saving.

In your situation from 2008-2012. If it was reported on your 2015 W-2.

Green Card Holder Exit Tax 8 Year Abandonment Rule New

What Are Itemized Deductions And Who Claims Them Tax Policy Center

How To Get Tax Refund In Usa As Tourist For Shopping 2021

What Are Itemized Deductions And Who Claims Them Tax Policy Center

What Are Itemized Deductions And Who Claims Them Tax Policy Center

Us Tax For Nonresidents Explained What You Need To Know

Best Refrence Valid Employment Letter Sample For B1 Visa By Httpwaldwert Visit Details Http Httpwaldwert Org Sponsorship Letter Letter To Parents Lettering

Us Tax For Nonresidents Explained What You Need To Know

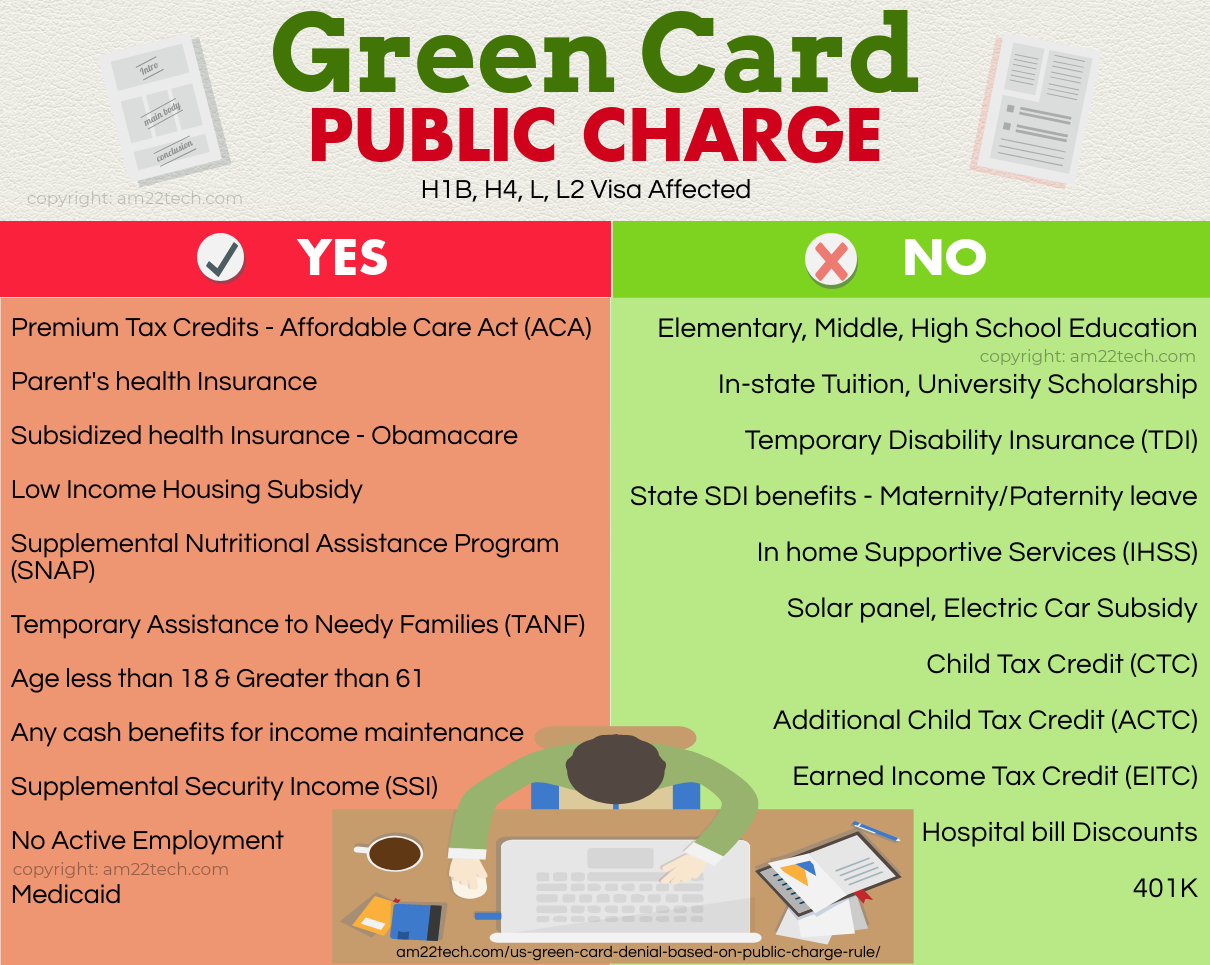

Green Card Public Charge Rule Removed H1b I485 Usa

Top 8 Tax Myths International Students In The Us Believe In

Us Tax For Nonresidents Explained What You Need To Know

Us Tax For Nonresidents Explained What You Need To Know

Italy Visa Requirements Fees And Guidelines For U S Citizenship And U S Passport Holders Schengenvisainfo Com

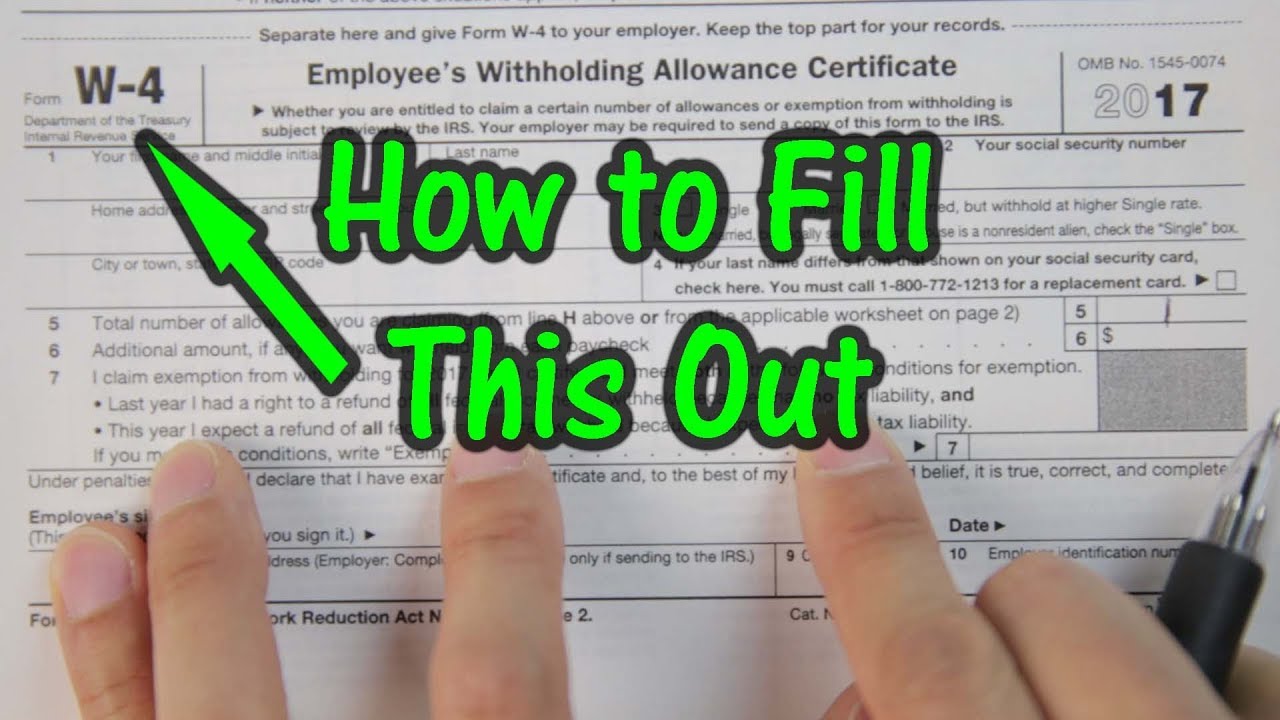

How To Fill Out Your W4 Tax Form Youtube

How To Fill Out Your W4 Tax Form Youtube

Us Tax For Nonresidents Explained What You Need To Know

Comments

Post a Comment